Does Afterpay Affect Credit Score? Find out Exactly How Your Acquisitions Might Influence It

Does Afterpay Affect Credit Score? Find out Exactly How Your Acquisitions Might Influence It

Blog Article

Reviewing Whether Afterpay Usage Can Impact Your Credit Report

As the appeal of Afterpay continues to rise, several people are left asking yourself concerning the potential impact this solution may have on their credit history ratings. The connection between Afterpay usage and credit rating ratings is a topic of passion for those intending to preserve or boost their economic health.

Comprehending Afterpay's Influence on Credit rating

The utilization of Afterpay can affect people' credit rating ratings, triggering a requirement for a thorough comprehension of its influence. Afterpay, a popular "acquire now, pay later" service, enables consumers to split their acquisitions right into smaller sized installment payments. While Afterpay does not perform credit history checks when clients originally join, late or missed out on payments can still impact credit history. When a customer misses out on a settlement, Afterpay might report this to credit score bureaus, resulting in an unfavorable mark on the individual's credit scores record. It is necessary for customers to recognize that while Afterpay itself does not naturally harm credit history, untrustworthy use can have effects. Monitoring payment due dates, maintaining an excellent settlement history, and ensuring all installments are paid in a timely manner are vital action in securing one's credit history rating when using Afterpay. By comprehending these subtleties, individuals can utilize Afterpay responsibly while minimizing any kind of possible adverse impacts on their credit history.

Variables That Influence Credit Report Modifications

Recognizing Afterpay's impact on credit score ratings exposes a direct web link to the different factors that can substantially affect modifications in a person's debt score gradually. One critical aspect is settlement history, making up about 35% of a credit report. Making on-time repayments regularly, consisting of those for Afterpay acquisitions, can positively impact the credit history. Credit scores use, that makes up around 30% of ball game, is one more vital element. Utilizing Afterpay sensibly without maxing out the available debt can aid keep a healthy credit report usage ratio. The size of credit scores history, contributing around 15% to the rating, is likewise important. Making use of Afterpay over a prolonged period can favorably impact this facet. In addition, new credit report queries and the mix of charge account can affect credit report. does afterpay affect credit score. Although Afterpay might not directly impact these variables, comprehending their relevance can assist individuals make educated decisions to maintain or boost their credit history ratings while utilizing services like Afterpay.

Tracking Credit Report Changes With Afterpay

Checking credit report changes with Afterpay includes tracking the impact of settlement behaviors and credit report utilization on overall credit score wellness. By utilizing Afterpay sensibly, individuals can preserve or boost their credit history. Timely settlements are vital, as missed out on or late payments can adversely influence credit report scores. Keeping an eye on payment due days and guaranteeing sufficient funds are offered to cover Afterpay installments can aid prevent any negative effect on credit report ratings. Furthermore, maintaining credit history usage reduced is vital. Utilizing Afterpay for little, manageable acquisitions and maintaining bank card balances reduced about credit line demonstrates responsible credit score behavior and can positively affect credit rating. Consistently reviewing credit history reports to check for any type of errors or inconsistencies associated with Afterpay purchases is additionally suggested. By staying attentive and proactive in keeping an eye on settlement practices and credit report use, individuals can properly handle their credit report while making use of Afterpay as a payment choice.

Tips to Handle Afterpay Responsibly

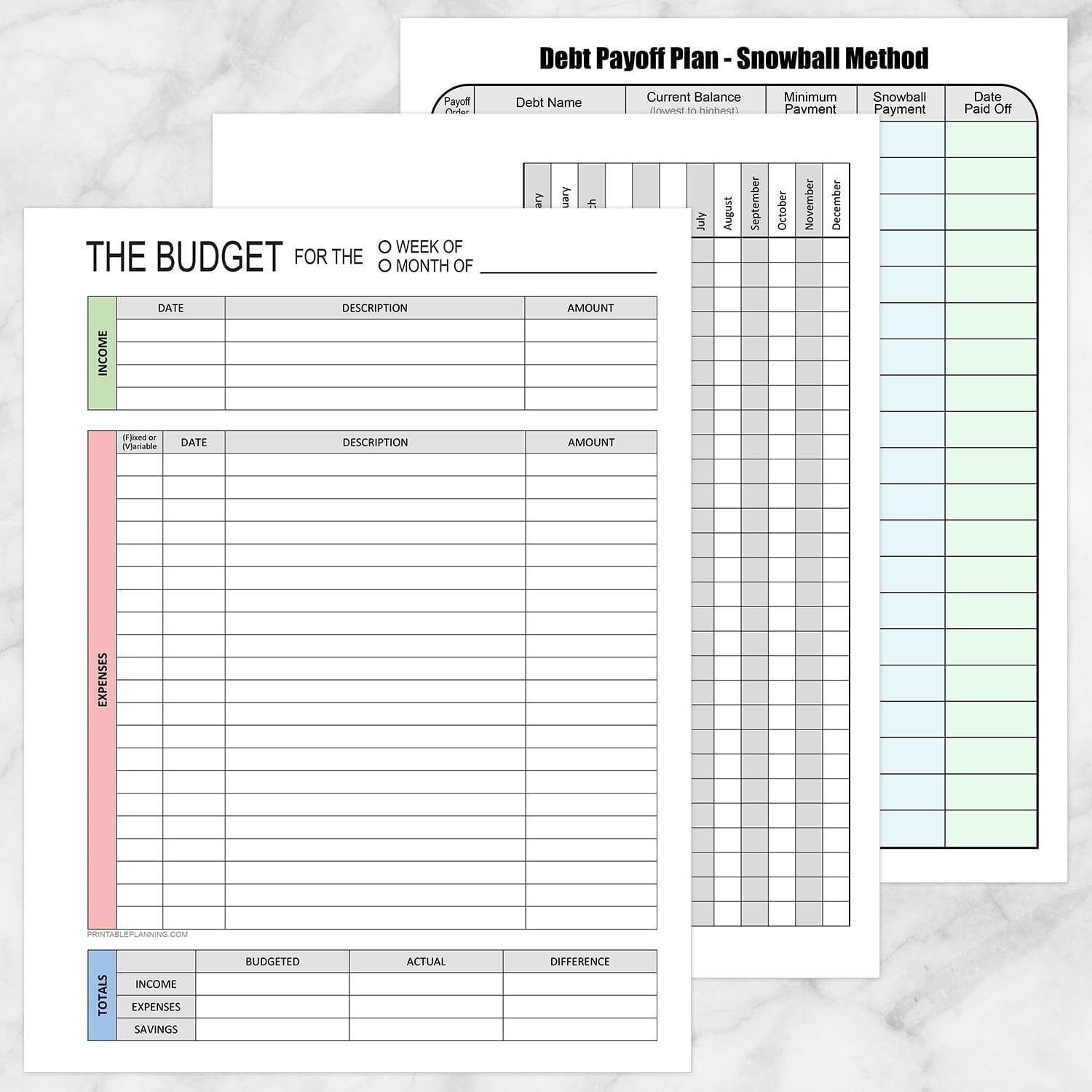

To browse Afterpay properly and preserve a healthy and balanced credit report, people can execute efficient methods to manage their economic commitments wisely. First of all, it is critical to develop a budget detailing income and expenditures to ensure price before committing to Afterpay acquisitions. This technique aids prevent overspending and accumulating debt over one's head's means. Secondly, using Afterpay uniquely for necessary items as opposed to indulgent purchases can assist in keeping economic security. Focusing on payments for needs can avoid unnecessary monetary pressure and advertise accountable spending practices. Furthermore, monitoring Afterpay settlement timetables and ensuring prompt settlements can aid prevent late costs and negative effect on credit history. Regularly keeping track of Afterpay purchases and total economic wellness via budgeting apps or spreadsheets can offer useful understandings right into spending patterns and aid in making enlightened financial decisions. By following these suggestions, individuals can take advantage of Afterpay responsibly while safeguarding their credit rating and financial health.

Conclusion: Afterpay's Duty in Debt Health And Wellness

In assessing Afterpay's effect on credit rating health and wellness, it ends up being apparent that prudent financial monitoring continues to be vital for people utilizing this solution. While Afterpay itself does not directly affect credit rating, forgeting repayments can bring about late fees and debt accumulation, which can indirectly influence credit reliability - does afterpay affect credit score. It is important for Afterpay customers to budget plan properly and make certain timely payments to promote a favorable debt standing

Furthermore, understanding how Afterpay incorporates with personal finance behaviors is vital. By utilizing Afterpay properly, individuals can delight in the ease of staggered payments without jeopardizing their credit history health and wellness. Checking spending, evaluating cost, and remaining within spending plan are basic techniques to stop monetary pressure and possible credit rating implications.

Final Thought

Recognizing Afterpay's impact on credit score scores reveals a direct link to the different right here aspects that can significantly influence adjustments in a person's credit report rating over time. Additionally, brand-new credit history queries and the mix of credit scores accounts can affect credit ratings.Checking credit rating score adjustments with Afterpay entails tracking the effect of payment behaviors and credit score utilization on total credit rating wellness - does afterpay affect credit score. Using Afterpay for tiny, workable acquisitions and maintaining credit report card equilibriums low relative to credit report limits shows liable credit report habits and can positively affect credit history scores. By remaining aggressive and vigilant in checking repayment behaviors and credit score application, individuals Website can properly handle their credit rating while making use of Afterpay as a repayment option

Report this page